ny mortgage refinance transfer taxes

A 20-year fixed-rate mortgage refinance of 100000 with todays interest rate of 476 will cost 647 per month in principal and interest. But fortunately homeowners arent required to pay the tax again once they refinance.

Pennsylvania Closing Cost And Mortgage Calculator Mortgage Calculator Online Mortgage Mortgage

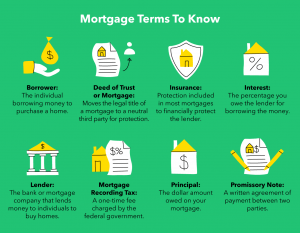

NY state imposes a mortgage tax of 05.

. How Much Is Mortgage Transfer Tax In Ny. The rates are published in Form. New York City Property Original Mortgage.

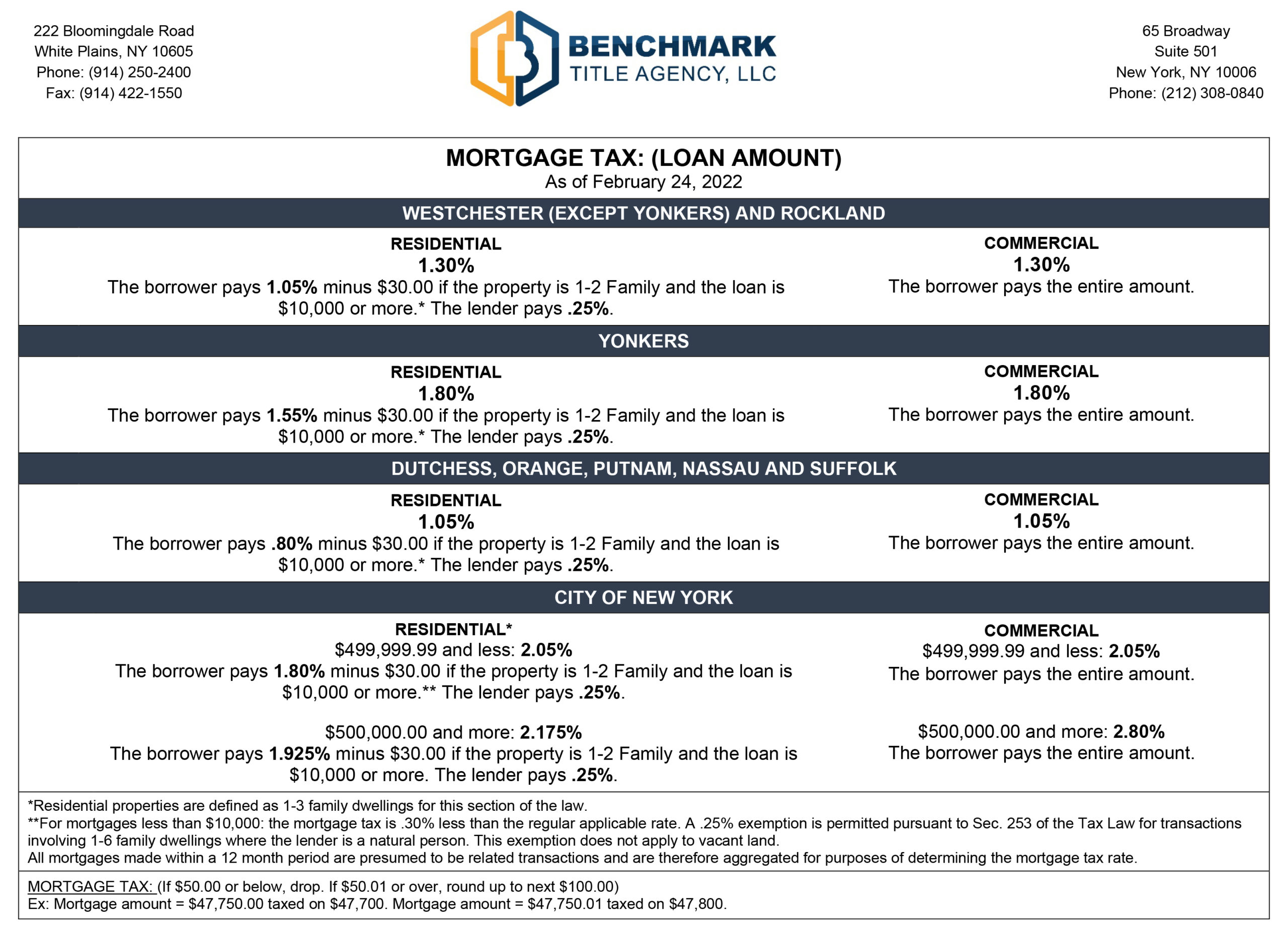

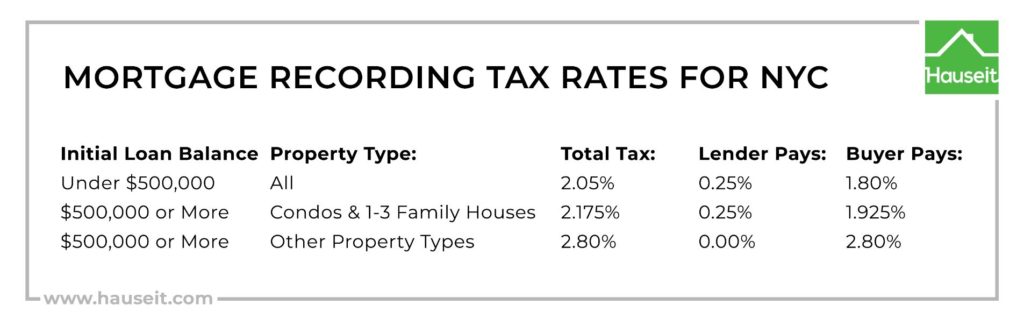

The Mortgage Recording Tax Rates in NYC are technically 205 for loan sizes below 500k and 2175 for loan sizes of 500k or more but the buyers lender typically pays 025 of the MRT. New York State also has a mansion tax. In spite of this refinanced homeowners are not required to re-pay the tax again.

It is important to note that the amounts for both mortgage taxes is based on the loan amount and not the purchase price of the real estate transaction. But fortunately homeowners arent required to pay the tax again once they refinance. It might also be added that apparently there is a transfer tax if you refinance and go from a title in a persons name to a title in that persons TRUST.

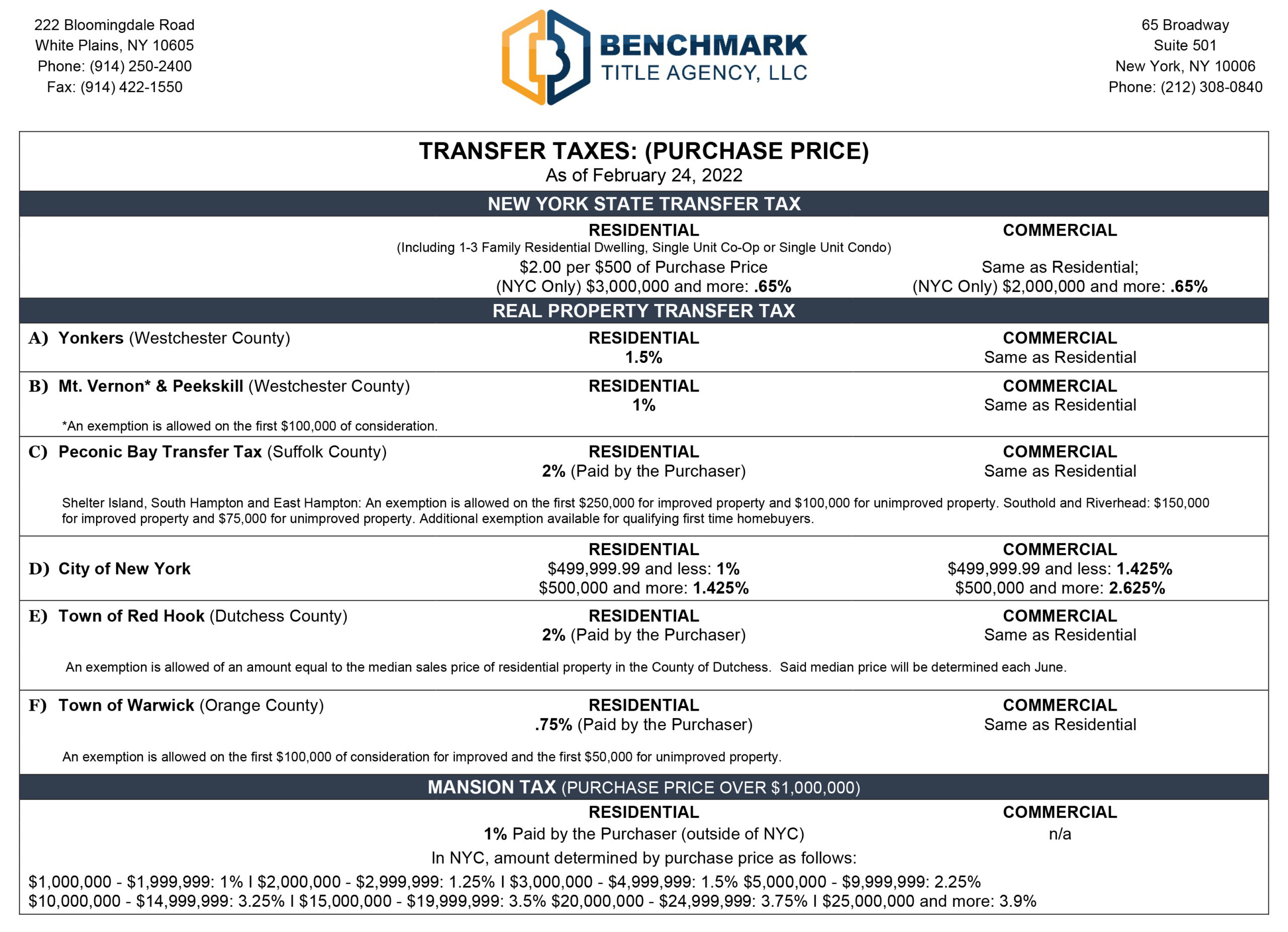

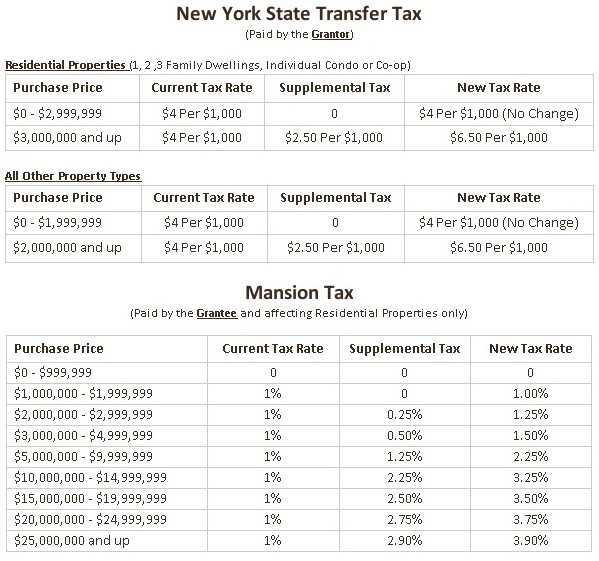

New York charges a NYS mortgage tax or specifically a recording tax on any new mortgage debt. In New York State the transfer tax is calculated at a rate of two dollars for every 500. Thats 1528750 in savings.

Yet they may end up doing so if their lenders dont cooperate. In many cases however a homeowner may be able to avoid the mortgage recording tax on a refinance if the original lender and the new lender cooperate. Ad Our Trusted Reviews Help You Make A More Informed Refi Decision.

The tax must be paid again when refinancing unless both the old lender and the new lender accept the Consolidation Extension Modification Agreement CEMA process. On a refinance of a 385000 mortgage on a single-family home in Brooklyn the mortgage recording tax would be 6900 for the homeowner and 96250 for the new lender Mr. The tax rate is an incremental rate between 25 and 29 based on the purchase price.

New York charges a NYS mortgage tax or specifically a recording tax on any new mortgage debt. If either one does not accept the process must be paid. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes.

For instance the real estate transfer tax would come to 1200 for a 300000 home. New York homeowners looking to refinance an existing mortgage dont have to pay the states mortgage recording tax all over again. Tax Law 1402 a.

That is usually the easiest way to not pay the tax. In a refinance transaction where property is not transferred between two parties no deedtransfer taxes are due. 750000 X 2175 1631250.

Perhaps the best bet is refinance with the existing lender. 700000 Refinance Loan Amount. Lender Doesnt Pay any of the Mortgage Tax CEMA Recorded Mortgage.

That means a home that sells for 1 million is. This rate varies by county with the minimum being 105 percent of the loan amount. Our guide to the NYC MRT will help you better understand this closing cost including who pays it how to calculate it and how to avoid or lower your overall mortgage tax liability.

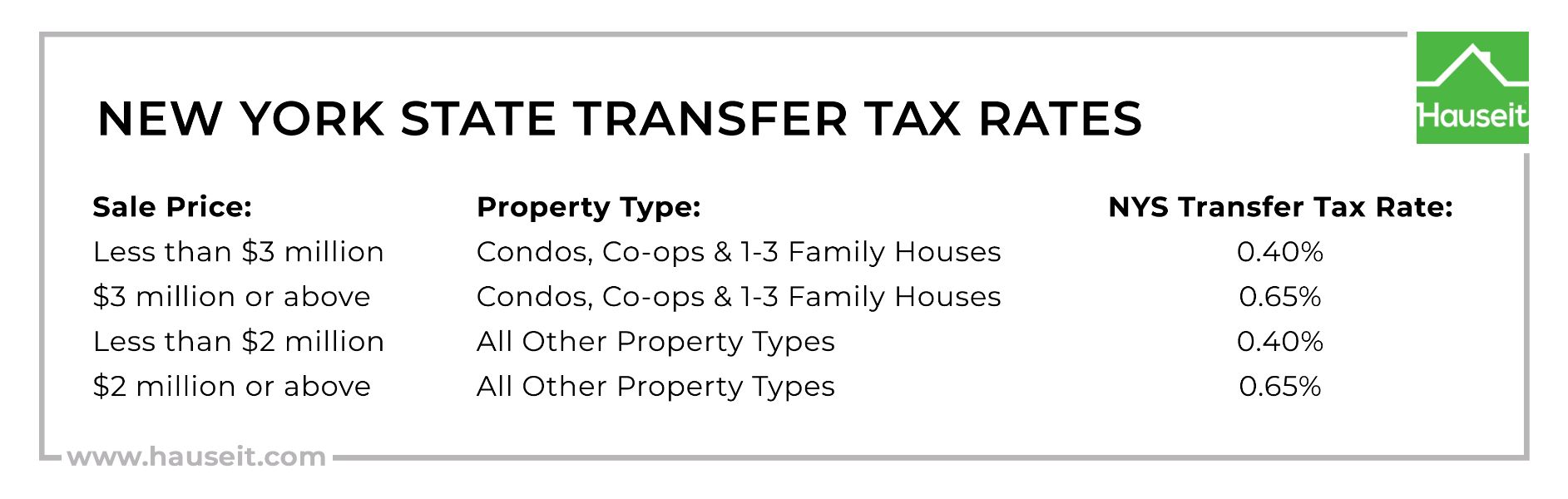

Therefore the effective Mortgage Recording Tax rates you pay as a buyer in NYC are 18 for loans under 500k and 1925 for loans of 500k or more. The New York State transfer tax rate is currently 04 of the sales price of a home. Taxes and fees are not included.

Article 31 of the New York State Tax Law imposes a real estate transfer tax the State Transfer Tax on each conveyance of real property or interest in real property if the consideration exceeds 500 with the tax being computed at the rate of 2 for each 500 of consideration or a fractional part thereof NY. Under 500000 8 is charged and above 500000 1. In order to make mortgage payments one must pay one percent of the mortgage recording tax.

13th Sep 2010 0328 am. A supplemental tax on the conveyance of residential real property or interest therein when the consideration is 2 million or more. New York State Mortgage Tax Rates County Name.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Properties with sales prices of 1 million or more are subject to an additional real estate transfer tax of 1. Rather than the Seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the mortgage obtained by Buyer.

This rate varies by county with the minimum being 105 percent of the loan amount. Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. What is NY State mortgage tax.

50000 x 205 1025 Recorded Mortgage on Full Refinanced Amount. The New York City Mortgage Recording Tax MRT rate is 18 for loans lower than 500000 and 1925 for loans of 500000 or more. Additional fees Associated with a CEMA.

In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. Do you have to pay NYS mortgage tax on a refinance.

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo

Transfer Tax Calculator 2022 For All 50 States

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Transfer Tax What It Is And Who Pays It Streeteasy

Heritus Mortgage Live Transfers Mortgage Loan Company Mortgage Loan Officer

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

The Mortgage Recording Tax In Nyc Explained By Hauseit Medium

Refinancing Your House How A Cema Mortgage Can Help

Reducing Refinancing Expenses The New York Times

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo Yoreevo

Real Estate Transfer Taxes In New York Smartasset

What Are Real Estate Transfer Taxes Forbes Advisor

Transfer Tax Reform Behind Nyc Luxury Apartment Sales Slump Nyc Apartment Luxury Luxury Sale Mansions